[ad_1]

In FY21, the year Covid struck, the company had provided a revenue growth guidance of 0-2%, but ended the year with growth at 5%. In 2009-10, it had guided for -6.7% to -3.7%, but ended at 3%. The company has a history of recording actual growth rates that are on average better than its guidance. Nonetheless, analysts expect Infosys to lag peers like TCS and HCLTech this year.

The sharp reduction on both ends of the guidance shows that deal ramp-ups have slowed amid uncertain macroeconomic conditions. Decision-making cycles are now longer, and there’s softness in discretionary spending. However, the very sharp downward revision of the guidance in just three months is also making analysts question Infosys’s visibility into its business.

The company has retained its operating margin guidance at 20% to 22%. At the press conference on Thursday, Infosys CEO Salil Parekh said the company has seen deal signings and deal start dates being delayed. “With that, we see revenue from some of the large and mega deals coming towards the later part of the financial year. Through the quarter, we have seen volumes in some of the clients (in financial services, asset management, mortgages and telco) being impacted, where they were reducing transformation projects or slowing down decision-making. When we combined those two and looked at the full year, we decided to change our growth guidance,” he said. Infosys signed $2.3 billion worth of large deals in the quarter, with 56.1% net new components.

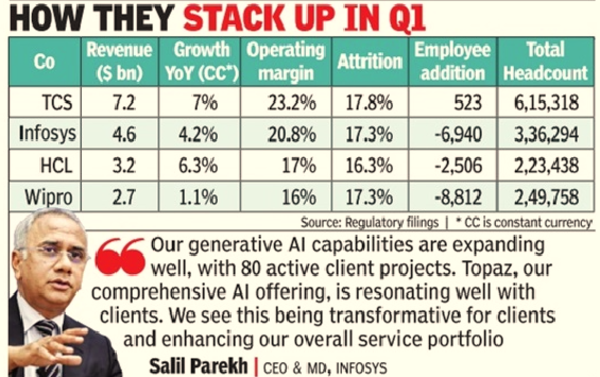

In the first quarter, Infosys’s revenue grew 4.2% year-on-year in constant currency and 1% sequentially. In reported dollar terms, it grew 3.9% year-on-year and 1.4% sequentially. The company did not call out, as it normally does, the share of digital in its overall business. Operating margin came in at 20.8%, a 20 basis point decline sequentially and 80 basis point drop year-on-year. The communication and financial services businesses declined 5.6% and 4.2% in constant currency respectively.

Asked about pricing, Infosys CFO Nilanjan Roy said it has been stable. The company’s net headcount dropped by 6,940 in the quarter to 3.3 lakh employees. Attrition declined to 17.3% from 20.9% in the March quarter. Infosys didn’t disclose a fresher hiring target for the fiscal. And when asked about when it would roll out wage hikes, Roy said, “It’s under consideration as we speak.”

[ad_2]

Source link

More Stories

India’S Growth Forecast: S&P ups India’s FY’24 growth forecast to 6.4% on robust domestic momentum

India to remain fastest-growing major economy, but demand uneven: Poll

Jack Ma: Jack Ma gets back into business with ‘Ma’s Kitchen Food’