[ad_1]

The relaxation, which is being “actively considered” according to sources who spoke to TOI, will be a significant reprieve for global companies that would need to fulfil domestic value addition conditions to avail the lower duty regime.

“The government is considering to exclude batteries, semiconductors, and magnetic parts from localisation conditions when it comes to import of electrics, and this can be a major benefit for companies such as Tesla that will take time to get its trusted supply chain to India even if it goes ahead and sets up a factory here over the coming years,” sources told TOI.

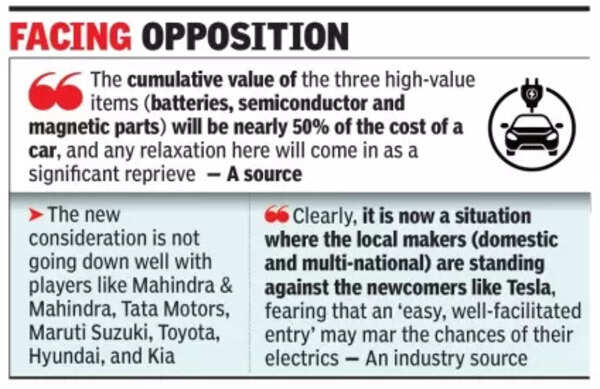

“The cumulative value of the three high-value items will be nearly 50% of the cost of a car, and any relaxation here will come in as a significant reprieve,” a person aware of the development said.

The new consideration is not going down well with local players (Mahindra & Mahindra and Tata Motors) and also foreign companies that have been operating in India for decades (such as Maruti Suzuki, Toyota, Hyundai, and Kia). The companies, already up in arms over the proposal to lower the import duty for electrics, are now voicing their opposition to any further relaxations when it comes to domestic value addition norms. “The local and other India-invested companies feel that they will be at a huge disadvantage, despite being the first ones to commit investments in electrics when the government had nudged the industry to rapidly go green and develop new products and supply partners.”

The sources said the local automobile grouping is now aggressively putting forward their views in conversations with the government even as industry body Society of Indian Automobile Manufacturers (Siam) firms up a representation on the matter. “Clearly, it is now a situation where the local makers (domestic and multi-national) are standing against the newcomers like Tesla, fearing that an ‘easy, well-facilitated entry’ may mar the chances of their electrics,” the source said.

However, a big influential grouping of German companies — Mercedes-Benz, Volkswagen group, and BMW — is sitting out and watching the developments from the sidelines. “The Germans are not averse to lower import duty, and even easier sourcing norms. However, they simply want lower investment commitments compared to the newcomers, especially as they have already made certain investments in India, if not very heavy ones.”

On the other hand, companies such as Maruti Suzuki and Toyota are cumulatively making heavy investments for a battery plant in Gujarat, and even the Hyundai-Kia Korean combine has similar plans. Tata Motors has also committed to make batteries locally, and in June announced plans to invest around Rs 13,000 crore for a lithium-ion cell factory in Gujarat.

[ad_2]

Source link

More Stories

India’S Growth Forecast: S&P ups India’s FY’24 growth forecast to 6.4% on robust domestic momentum

India to remain fastest-growing major economy, but demand uneven: Poll

Jack Ma: Jack Ma gets back into business with ‘Ma’s Kitchen Food’