[ad_1]

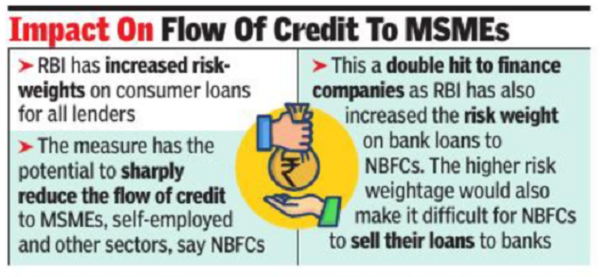

The Finance Industry Development Council, an association of NBFCs, has said that while new rules are in the interest of banks and NBFCs and will provide additional safeguards, they will cause collateral damage to small businesses.”We request RBI to re-evaluate the sharp increase in risk weights assigned to bank loans to NBFCs. The measure inadvertently has the potential to sharply reduce the flow of credit to MSMEs, self-employed and other sectors which rely upon credit from NBFCs,” saidMahesh Thakkar, director general, FIDC.

The FIDC expressed its appreciation for RBI’s decision to implement measures addressing high growth in certain components of consumer credit. It also supported the effort to differentiate between consumption-oriented credit and credit for industrial and commercial growth.

“This would redirect credit flow towards capital expenditure and aid in a greater degree of funds flow towards meeting working capital needs, especially of the MSME and self-employed sectors,” the representation said.

While RBI has increased risk-weights on consumer loans for all lenders, it is a double hit for finance companies as RBI has also increased the risk weight on bank loans to NBFCs. It would also make it difficult for NBFCs to sell their loans to banks.

“Loan sell-down by personal loan NBFCs amounted to about Rs 1,150 crore in FY23 and had already crossed Rs 800 crore in H1 FY24,” said Abhishek Dafria, senior vice president at Icra.

[ad_2]

Source link

More Stories

India’S Growth Forecast: S&P ups India’s FY’24 growth forecast to 6.4% on robust domestic momentum

India to remain fastest-growing major economy, but demand uneven: Poll

Jack Ma: Jack Ma gets back into business with ‘Ma’s Kitchen Food’