[ad_1]

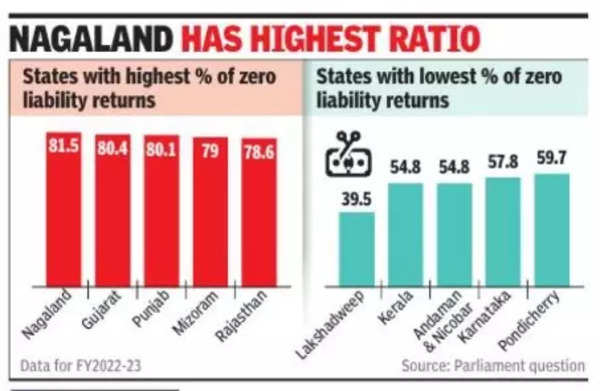

At an all-India level of the 7. 4 crore returns filed during the financial year 2022-23, a little under 5. 2 crore or around 70% had no tax liability.

The state-wise numbers shared in Lok Sabha put Maharashtra on top of the heap on both counts — over 1. 1 crore returns filed with nearly 74 lakh zero-liability ITRs. At the other end of the spectrum is Lakshadweep, where less than 40% or 1,761 returns of the 4,454 filed had zero liability. Gujarat saw 74. 5 lakh returns filed during the last financial year.

While taxpayers earning under Rs 2. 5 lakh in a financial year do not have to pay income tax, several individuals file returns as they have to claim refunds, say fortax deducted at source or just to have a record so that they can avail of a loan. Often, when an individual, who is a taxpayer, sees a fall in income below the threshold, a return is filed.

Besides, with standard deduction and exemptions the actual income required for paying taxes is now much higher.

[ad_2]

Source link

More Stories

India’S Growth Forecast: S&P ups India’s FY’24 growth forecast to 6.4% on robust domestic momentum

India to remain fastest-growing major economy, but demand uneven: Poll

Jack Ma: Jack Ma gets back into business with ‘Ma’s Kitchen Food’