[ad_1]

Foreign exchange traders are drawing from the market reaction to the US downgrade by international rating agency S&P in 2011. The S&P downgrade had led to a steep fall in stock markets globally and a rise in bond yields.

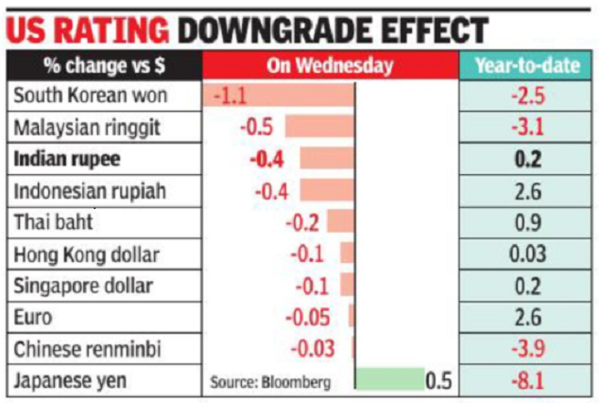

However, economists are not expecting a major fallout this time. “The US hasn’t experienced a substantial downward shift in its rating trajectory to trigger a rebalancing. Compared to the first time the US was downgraded in 2011, I don’t believe it will have a major market impact,” said Rahul Bajoria, MD of Barclays Investment Bank. He added that a US downgrade wasn’t among the primary concerns for most people. While the rupee weakened more than Chinese, Indonesian, and Taiwanese currencies, it was more resilient than the South African rand, Malaysian ringgit and won, which fell the most at 1.1% (see graphic).

On a year-to-date basis, the rupee has appreciated against the dollar. Dealers said that the rupee would have firmed up further had it not been for periodic interventions by the RBI.

“The US 10-year bond yield spiking above 4% and the dollar index rising to 102 are near-term negatives for emerging markets. But it is important to note that the downgrade doesn’t say anything the market doesn’t know. So, the negative knee-jerk reaction will be short-lived. Globally, equity markets have been rising on the US economy’s soft landing narrative. The downgrade doesn’t alter that,” said V K Vijaykumar of Geojit Financial Services.

[ad_2]

Source link

More Stories

India’S Growth Forecast: S&P ups India’s FY’24 growth forecast to 6.4% on robust domestic momentum

India to remain fastest-growing major economy, but demand uneven: Poll

Jack Ma: Jack Ma gets back into business with ‘Ma’s Kitchen Food’