[ad_1]

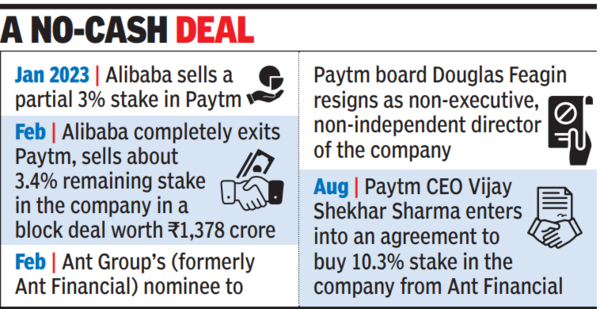

The move is being seen as an attempt by the fintech major to reduce Chinese ownership in the firm at a time when Indian companies with Chinese holdings are increasingly coming under scrutiny of regulators.

“Both RBI and Sebi are very clear about the fact that they will not allow entities with large Chinese ownership to participate in the financial services industry in the country. So long as a large Chinese overhang exists for Paytm, they will not be able to get relevant licences to expand their business. There are obviously implications to its business model and hence this arrangement has been arrived at,” said an investor on condition of anonymity, adding that it is yet to be seen if the move softens the stance of regulators. “It does not seem to be like a typical buyout. In this case, the economic rights belong with someone and the ownership with someone else. We will have to see how it pans out,” the investor said.

Experts suggested that eventually Paytm might prefer Ant Financial to fully exit the firm.”Ant Financial cannot divest 13.5% at one shot. I think it will happen in a phase manner,” said an analyst.

Following the development, the share price of One97 Communications, which owns Paytm, ended at Rs 851 apiece on BSE, up 7%.

Sharma will acquire the stake through Netherlands-based Resilient Asset Management, B.V., an entity fully owned by him through an off-market transfer, Paytm parent One97 Communications said in a stock exchange filing. Ant Financial is participating in the transaction through its affiliate Antfin (Netherlands) Holding B.V.

“Under the agreement executed between parties, Resilient will acquire ownership, and voting rights, of the 10.3% block. In consideration for acquisition of the 10.30% stake, Resilient will issue optionally convertible debentures (OCDs) to Antfin, which, in turn, will allow Antfin to retain economic value of 10.3% stake….accordingly, no cash payment will be made for this acquisition, and neither will any pledge, guarantee, or other value assurance be provided by Sharma,” the company said.

[ad_2]

Source link

More Stories

India’S Growth Forecast: S&P ups India’s FY’24 growth forecast to 6.4% on robust domestic momentum

India to remain fastest-growing major economy, but demand uneven: Poll

Jack Ma: Jack Ma gets back into business with ‘Ma’s Kitchen Food’