[ad_1]

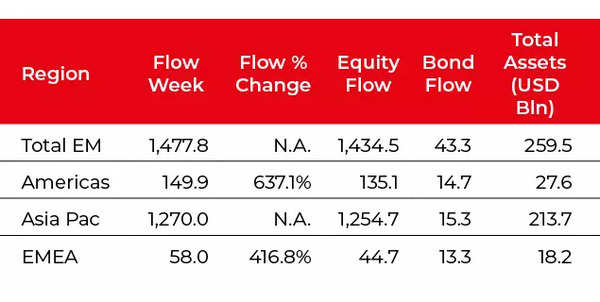

Investors in US exchange-traded funds favored Indian stocks more than any other country’s last week as China’s sluggish recovery leaves the South Asian nation as the main growth engine of emerging markets.

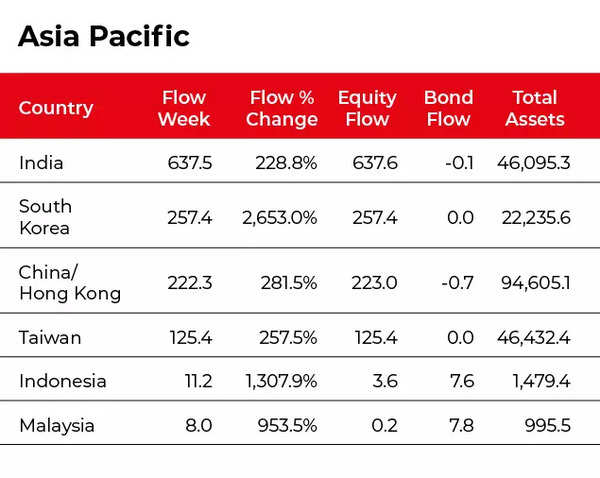

Inflows into funds that invest in Mumbai-listed shares totaled about $638 million in the five days to July 14, while those buying Chinese equities received $223 million.

Inflows into funds that invest in Mumbai-listed shares totaled about $638 million in the five days to July 14, while those buying Chinese equities received $223 million.

The benchmark Sensex rose to a record high on Monday, extending its gains from late March to 16% in both rupee and dollar terms.

Concerns about China deepened after the world’s second-biggest economy reported quarterly growth below estimates.

With Beijing underscoring its resolve to provide only targeted support, and avoid a broader stimulus, the nation’s equity outlook remains clouded.

Meanwhile, domestic consumer demand and a pause in interest-rate hikes are seen driving a 7% growth for India this year, about 1.5 percentage points faster than China’s and the quickest among major economies.

[ad_2]

Source link

More Stories

India’S Growth Forecast: S&P ups India’s FY’24 growth forecast to 6.4% on robust domestic momentum

India to remain fastest-growing major economy, but demand uneven: Poll

Jack Ma: Jack Ma gets back into business with ‘Ma’s Kitchen Food’