[ad_1]

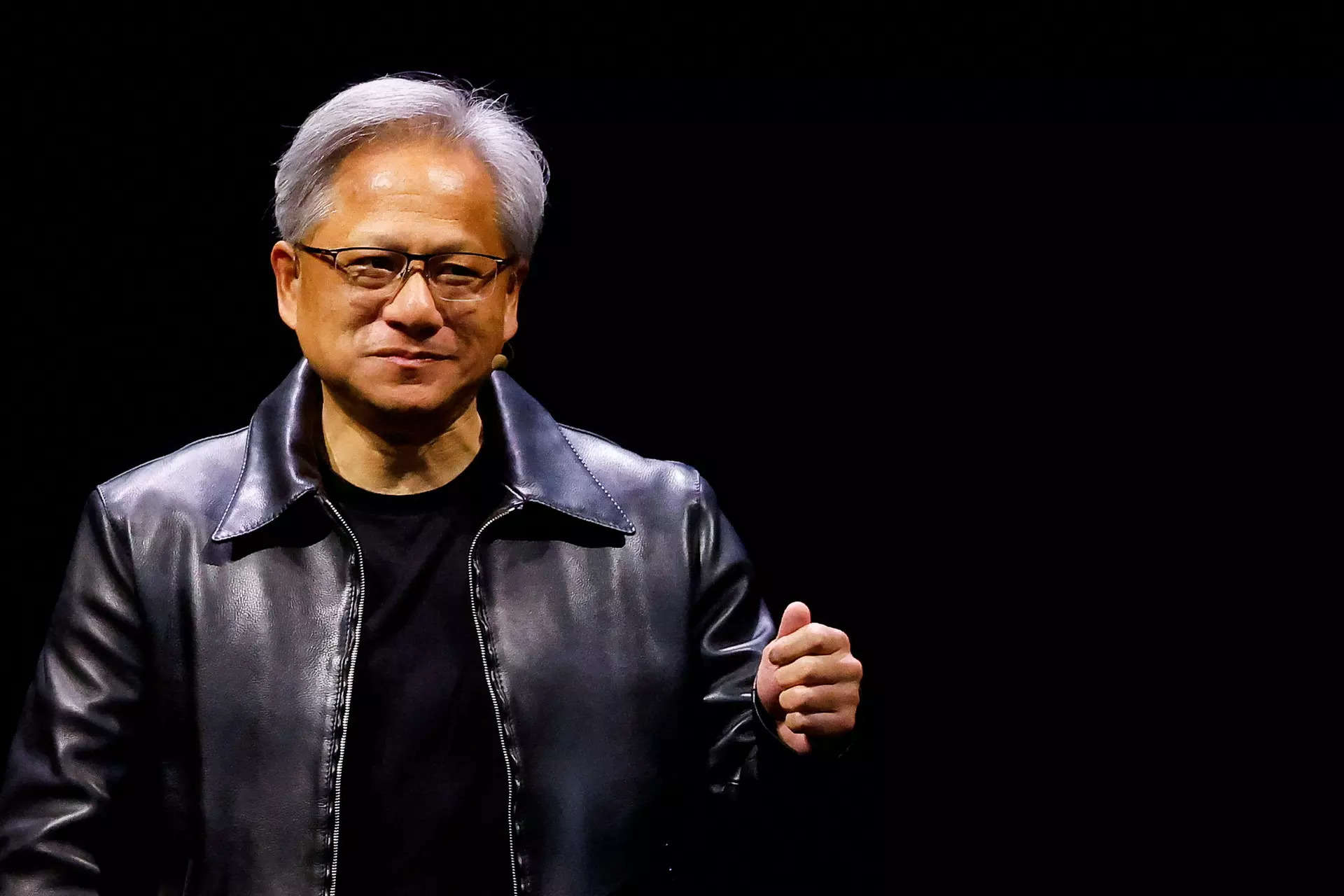

NEW DELHI: During a five-day tour of India earlier this month, Nvidia Corp chief executive officer Jensen Huang visited four cities, dined with tech executives and researchers, took numerous selfies, and sat for a one-on-one conversation with Prime Minister Narendra Modi about the AI sector. Huang’s India itinerary was so crammed that he confessed to surviving entire work days on spicy masala omelets and cold coffees.

Huang may have been treated like a head of state, but the trip’s purpose was all business. For Nvidia, whose graphics processors are vital to the development of artificial intelligence systems, the South Asian nation of 1.4 billion people presents a rare opportunity. As the US increasingly clamps down on exports of high-end chips to China and the world seeks an alternative electronics manufacturing base, India could shape up to be a source of AI talent, site for chip production and market for Nvidia’s products.

At a meeting with leading researchers in Delhi, Huang spoke of re-training entire swaths of the country’s workforce and building future AI models using Indian data and talent, according to multiple attendees. Huang also told one executive in India’s tech hub Bangalore that he’s a big believer in the country’s engineering talent, particularly graduates from its top engineering schools, Indian Institutes of Technology.

“You have the data, you have the talent,” Huang said at a news conference in Bangalore. Huang added: “This is going to be one of the largest AI markets in the world.”

Nvidia and India have a shared interest in betting on, and speeding up, the country’s AI ascendancy. Chipmakers cannot sell top-end microprocessors to China, which accounts for a fifth of Nvidia’s sales, amid fears the chips could be used to develop autonomous weaponry or wage cyberwarfare. “India is the only market remaining so it isn’t surprising that Nvidia wants to put multiple eggs in that basket,” said Neil Shah, vice president of research at Counterpoint Technology Market Research.

While Indian engineers are a vital part of the digital workforce, the country is still far away from developing the cutting-edge capabilities needed to manufacture Nvidia’s sophisticated chips. But India has ambitions to boost electronics manufacturing as well as harness AI to buoy its digital economy. The country is plowing billions in subsidies to set up chip manufacturing infrastructure to lure the likes of Nvidia, Advanced Micro Devices Inc and Intel Corp.

“India is strategic to Nvidia’s future,” said Nandan Nilekani, chairman of Infosys Ltd. and a designer of vital portions of the country’s massive digital public infrastructure. “The government is aggressively building AI infrastructure and so are large private companies. That’s good news for Huang,” said Nilekani, who dined with the chip billionaire during the visit.

In Delhi, the Taiwanese-American billionaire showed up at the prime minister’s residence in his trademark black leather jacket, braving sweltering 90-plus-degree summer temperatures. Modi later shared that the two talked about “the rich potential India offers in the world of AI.”

Huang and Nvidia saw signs of that potential during the trip. India’s largest conglomerate, Reliance, owned by billionaire Mukesh Ambani, announced during Huang’s multi-city tour that its Jio Platforms would build AI computing infrastructure for the country. The AI cloud will use end-to-end Nvidia supercomputing technologies, the company said in a release. Reliance and another large conglomerate, Tata, will also build and operate state-of-the-art AI supercomputing data centers and offer AI infrastructure as a service for use by researchers, corporations and startups, Nvidia said, without giving details or sharing timelines.

India has had reasonable success in enticing giants Apple Inc and Amazon.com Inc to shift contract electronics manufacturing from China — to a point where, this month, Apple will sell India-made iPhone 15 devices on launch day. Now it’s turning to semiconductors, armed with some experience in chip design and no history whatsoever in semiconductor foundries. Nearly all cutting-edge chips, including those designed by Nvidia, are made in Taiwan. Over several decades, the country spent billions to reach current levels of manufacturing sophistication.

India wants to catch up, but it faces challenges turning itself into an AI hub. The country currently has no exascale compute capacity — being able to handle a billion billion calculations per second — nor the ready AI talent capable of writing sophisticated software, said Sashikumaar Ganesan, who chairs the computational and data sciences department at Indian Institute of Science. “We have to build not just AI infrastructure but also high-performance computing workforce,” said Ganesan, who was among those invited to Huang’s meeting with AI researchers.

Still, India is a fast-maturing market for high-end technologies, said K Krishna Moorthy, CEO of trade group India Electronics and Semiconductor Association. That’s created huge demand for Nvidia’s GPUs, or graphics processing units. “As India’s digital economy grows, the government is mandating data security, data privacy and data localization, and this could require over 100,000 GPUs to build AI cloud infrastructure,” Moorthy said.

The country has telecom giants like Reliance’s Jio which collect billions of data points daily from its half a billion mobile users and hundreds of millions of retailers. “The data generated from 1.4 billion Indians could set the country up for the next phase of digital growth,” said Moorthy. “Huang understands this is where the next phase of growth for AI-enabling chips will happen.”

Nvidia already has four engineering centers in India, including in Bangalore and in the Gurgaon suburbs of Delhi, with a total of 4,000 engineers, its second-biggest talent pool after the US. During his trip, Huang held town halls at each of the locations and stressed the importance of remaining competitive in a rapidly evolving AI marketplace. While speaking to employees, he repeated a line he’s used in public before, offering his twist on the hunt-or-be-hunted adage: Either you are running for food or running away from being food.

Huang may have been treated like a head of state, but the trip’s purpose was all business. For Nvidia, whose graphics processors are vital to the development of artificial intelligence systems, the South Asian nation of 1.4 billion people presents a rare opportunity. As the US increasingly clamps down on exports of high-end chips to China and the world seeks an alternative electronics manufacturing base, India could shape up to be a source of AI talent, site for chip production and market for Nvidia’s products.

At a meeting with leading researchers in Delhi, Huang spoke of re-training entire swaths of the country’s workforce and building future AI models using Indian data and talent, according to multiple attendees. Huang also told one executive in India’s tech hub Bangalore that he’s a big believer in the country’s engineering talent, particularly graduates from its top engineering schools, Indian Institutes of Technology.

“You have the data, you have the talent,” Huang said at a news conference in Bangalore. Huang added: “This is going to be one of the largest AI markets in the world.”

Nvidia and India have a shared interest in betting on, and speeding up, the country’s AI ascendancy. Chipmakers cannot sell top-end microprocessors to China, which accounts for a fifth of Nvidia’s sales, amid fears the chips could be used to develop autonomous weaponry or wage cyberwarfare. “India is the only market remaining so it isn’t surprising that Nvidia wants to put multiple eggs in that basket,” said Neil Shah, vice president of research at Counterpoint Technology Market Research.

While Indian engineers are a vital part of the digital workforce, the country is still far away from developing the cutting-edge capabilities needed to manufacture Nvidia’s sophisticated chips. But India has ambitions to boost electronics manufacturing as well as harness AI to buoy its digital economy. The country is plowing billions in subsidies to set up chip manufacturing infrastructure to lure the likes of Nvidia, Advanced Micro Devices Inc and Intel Corp.

“India is strategic to Nvidia’s future,” said Nandan Nilekani, chairman of Infosys Ltd. and a designer of vital portions of the country’s massive digital public infrastructure. “The government is aggressively building AI infrastructure and so are large private companies. That’s good news for Huang,” said Nilekani, who dined with the chip billionaire during the visit.

In Delhi, the Taiwanese-American billionaire showed up at the prime minister’s residence in his trademark black leather jacket, braving sweltering 90-plus-degree summer temperatures. Modi later shared that the two talked about “the rich potential India offers in the world of AI.”

Huang and Nvidia saw signs of that potential during the trip. India’s largest conglomerate, Reliance, owned by billionaire Mukesh Ambani, announced during Huang’s multi-city tour that its Jio Platforms would build AI computing infrastructure for the country. The AI cloud will use end-to-end Nvidia supercomputing technologies, the company said in a release. Reliance and another large conglomerate, Tata, will also build and operate state-of-the-art AI supercomputing data centers and offer AI infrastructure as a service for use by researchers, corporations and startups, Nvidia said, without giving details or sharing timelines.

India has had reasonable success in enticing giants Apple Inc and Amazon.com Inc to shift contract electronics manufacturing from China — to a point where, this month, Apple will sell India-made iPhone 15 devices on launch day. Now it’s turning to semiconductors, armed with some experience in chip design and no history whatsoever in semiconductor foundries. Nearly all cutting-edge chips, including those designed by Nvidia, are made in Taiwan. Over several decades, the country spent billions to reach current levels of manufacturing sophistication.

India wants to catch up, but it faces challenges turning itself into an AI hub. The country currently has no exascale compute capacity — being able to handle a billion billion calculations per second — nor the ready AI talent capable of writing sophisticated software, said Sashikumaar Ganesan, who chairs the computational and data sciences department at Indian Institute of Science. “We have to build not just AI infrastructure but also high-performance computing workforce,” said Ganesan, who was among those invited to Huang’s meeting with AI researchers.

Still, India is a fast-maturing market for high-end technologies, said K Krishna Moorthy, CEO of trade group India Electronics and Semiconductor Association. That’s created huge demand for Nvidia’s GPUs, or graphics processing units. “As India’s digital economy grows, the government is mandating data security, data privacy and data localization, and this could require over 100,000 GPUs to build AI cloud infrastructure,” Moorthy said.

The country has telecom giants like Reliance’s Jio which collect billions of data points daily from its half a billion mobile users and hundreds of millions of retailers. “The data generated from 1.4 billion Indians could set the country up for the next phase of digital growth,” said Moorthy. “Huang understands this is where the next phase of growth for AI-enabling chips will happen.”

Nvidia already has four engineering centers in India, including in Bangalore and in the Gurgaon suburbs of Delhi, with a total of 4,000 engineers, its second-biggest talent pool after the US. During his trip, Huang held town halls at each of the locations and stressed the importance of remaining competitive in a rapidly evolving AI marketplace. While speaking to employees, he repeated a line he’s used in public before, offering his twist on the hunt-or-be-hunted adage: Either you are running for food or running away from being food.

[ad_2]

Source link

More Stories

India’S Growth Forecast: S&P ups India’s FY’24 growth forecast to 6.4% on robust domestic momentum

India to remain fastest-growing major economy, but demand uneven: Poll

Jack Ma: Jack Ma gets back into business with ‘Ma’s Kitchen Food’