[ad_1]

How has the Indian government done in the last 10 years? Do you think it has taken advantage of the opportunities that arose from changes in geopolitical equations?

It looks like they have. Didn’t Apple move some of their manufacturing here? You can have other people do the same thing. I guess they call it ‘China Plus One’. India’s already done a great job with the global services export. So, it is a manufacturing opportunity.

What’s the feedback from investors? Do you expect equity portfolio flows to accelerate after the inclusion in bond indices?

… Because India is 10% of the index, it will add $25 billion of foreign bond purchases. It is a very good thing for India to be part of the index because it has other ramifications and implications about transparency and the country’s growth. So, it will help equity flows into India.

You have increased the headcount in global capability centres. Did Covid boost remote working…

It has nothing to do with Covid. In 2005, we had 6,000 people here, and we covered 20 companies. We were a very small investment bank with a small sales and trading operation. Today, we cover around 120 companies, bring in 400-500 multinationals, and have 50,000 people. Back then, the service centres were mostly call centres and operations. Today, it is everything we do as a company – data science, cyber, research. That is because of the talent and capability of the people. All these folks here also take jobs with JP Morgan outside India, and in my view, that is going to continue for the next 20 years.

Will the offshoring trend continue to grow?

We were probably the biggest of the financial companies. You wouldn’t have your service exports without these service centres. What they do has dramatically gone upscale. I am visiting our Mumbai centre on Tuesday, and it is quite extraordinary.

During your 2021 visit, you said interest rates were likely to rise. Did you expect them to hit the current levels?

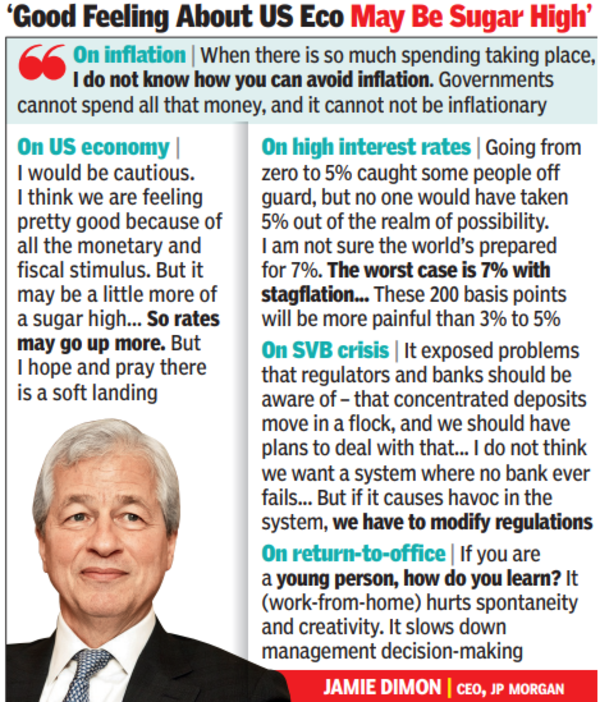

When we talked about the economy, I didn’t know what would happen, but the chances of inflation and rates going higher were pretty good, and we were prepared for it. When there is so much spending taking place, I do not know how you can avoid inflation. Governments cannot spend all that money, and it cannot not be inflationary.

What are the risks of a hard landing for the US economy?

No one knows. There is a range of outcomes. It will be affected by everything else – Ukraine, oil, gas, war, Europe. I would be cautious. I think we are feeling pretty good because of all the monetary and fiscal stimulus. But it may be a little more of a sugar high. We have to deal with all these serious issues over time, and your deficits can’t continue forever. So rates may go up more. But I hope and pray there is a soft landing.

When rates go up sharply, there is stress in debt repayments. How are businesses living with such high rates?

First of all, interest rates went to zero. Going from zero to 2% was almost no increase. Going from zero to 5% caught some people off guard, but no one would have taken 5% out of the realm of possibility. I am not sure if the world is prepared for 7%. I ask people in business, ‘are you prepared for something like 7%?’ The worst case is 7% with stagflation. If they are going to have lower volumes and higher rates, there will be stress in the system. We urge our clients to be prepared for that kind of stress. Warren Buffett says you find out who is swimming naked when the tide goes out. That will be the tide going out. These 200bps will be more painful than the 3% to 5%.

The SVB crisis has drawn comments on the risks posed by combining digital banking with social media-fuelled bank runs. Does that make all banks too big to fail?

I think that is being blown out of proportion. Social media and online banking existed during the great financial crisis. Only a handful of banks had the problem – Silicon Valley Bank, First Republic Bank and Signature. Other banks did not have a problem. It did expose other problems that regulators and banks should be aware of – that concentrated deposits move in a flock, and we should have plans to deal with that. The problem of interest rate exposure was known to everyone. I do not think we want a system where no bank ever fails. So, having a bunch of failures is not a terrible thing. But if it causes havoc in the system, we have to modify regulations to stop that from happening.

You have been an advocate of return-to-office…

JP Morgan is a microcosm of the broader people. About 60% of the people are in office 100% of the time, which was the case even during Covid for manufacturers, bank branches, doctors, hospitals, police and firemen. So it is the other 40% that you are talking about. There are certain jobs where you can work from home. I think there is a whole function of jobs where people are doing two or three days where it is unclear. You have to be very specific. Does it work for the company? The clients? There are negatives; it is not just binary. If you are a young person, how do you learn? It hurts spontaneity and creativity. It slows down management decision-making. Most people learn because they are in sales calls or meetings. We are 60% full-time, all MDs are in full-time and we are sorting out the rest. If it does not work, we are going to get rid of it. This is not about the squeaky wheel deciding what is good for JP Morgan clients.

India has been pushing for crypto regulation in the G20 summit. The RBI wants a ban…

They are right. You have to separate the world into crypto that does something – foundations for smart contracts or data that can be moved easily so it creates value somewhere. I think that is taking place a little bit. If it took the form of currency, which is supposed to be a store of value, that is a fraud; it should be closed down.

The other issue in G20 was high charges on sending money through banks across borders…

You are absolutely right. It is a problem particularly for America, because lot of people send remittances home and it costs too much money and takes too long. I do think the government can help the solution by allowing international accounts to move in real time for small consumer accounts with proper protections. There are a bunch of fintechs that are solving the problem. It is not the big banks that are getting those fees. These are other money movers.

[ad_2]

Source link

More Stories

India’S Growth Forecast: S&P ups India’s FY’24 growth forecast to 6.4% on robust domestic momentum

India to remain fastest-growing major economy, but demand uneven: Poll

Jack Ma: Jack Ma gets back into business with ‘Ma’s Kitchen Food’