[ad_1]

Aditya Birla Finance can raise up to Rs 2,000 crore through this NCDs issue, which opens from September 27 to October 12, with the possibility of early closure due to oversubscription. These NCDs carry the highest AAA credit rating, a face value of Rs 1,000 each, and require a minimum application of 10 NCDs worth Rs 10,000.

Fixed Income Mutual Funds Vs Fixed Deposits: What should you do in high interest rate scenario?

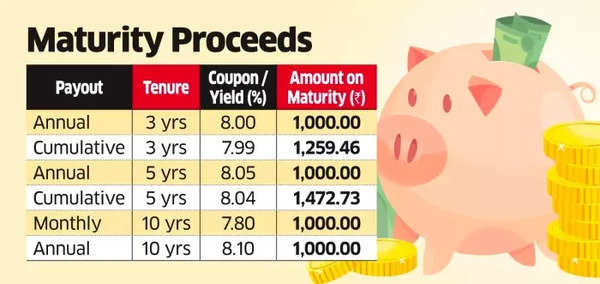

The NCDs come with three, five, and ten-year tenures, offering investors annual interest rates of 8%, 8.05%, and 8.10%, respectively. Investors can choose between annual or cumulative interest options for all three maturities. However, the monthly interest payment option, with a 7.8% annual rate, is available only for the ten-year option. These NCDs do not include put or call options.

Aditya Birla Finance’s Non-Convertible Debentures

Vikram Dalal, Managing Director at Synergee Capital, highlighted the opportunity these NCDs present, offering returns that are 50-100 basis points higher than bank deposits and other AAA-rated products. Additionally, NCDs are liquid as they are listed on the stock exchange. Dalal recommended considering the three- or five-year options in the Aditya Birla issue. Dalal said that in comparison, other AAA-rated bonds like Tata Capital, LIC Housing, PFC, and REC provide yields between 7.5% and 7.9% for three to five-year tenures.

SBI’s fixed deposits with tenures ranging from three to ten years offer returns of 6.5-7%.

PPF, Senior Citizen Savings, NSC, Sukanya Samriddhi, MIS, Small Saving Schemes Explained & Compared

Some wealth managers suggest that senior citizens, especially those fully invested in the government’s Senior Citizens Savings Scheme (SCSS), could also consider investing in these NCDs. Viral Bhatt, founder of Money Mantra, a Mumbai-based financial products distributor, advised senior citizens with no liquidity concerns to explore SCSS limits first and then consider products like these NCDs for investment.

[ad_2]

Source link

More Stories

India’S Growth Forecast: S&P ups India’s FY’24 growth forecast to 6.4% on robust domestic momentum

India to remain fastest-growing major economy, but demand uneven: Poll

Jack Ma: Jack Ma gets back into business with ‘Ma’s Kitchen Food’