[ad_1]

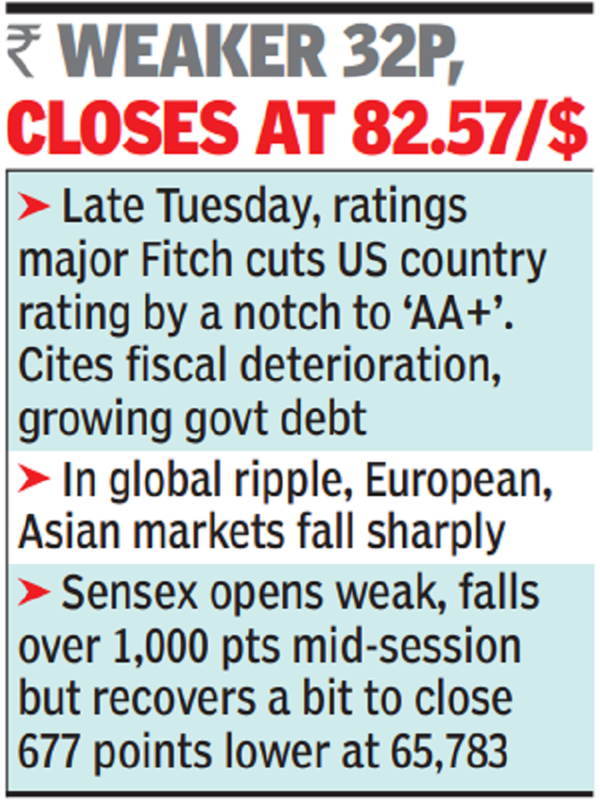

This pulled the sensex down by 677 points or 1% to 65,783 points, its first close in the sub-66k region since July 13. HDFC Bank, Reliance Industries and ICICI Bank led the slide. On the NSE, the nifty lost 207 points or 1% to close at 19,527 points.

The weakness in the global markets also affected the rupee that closed at 82.57 to the dollar, weaker by 32 paise from its Tuesday close. In the government bond market, although the prices fell initially and yields hardened, at close the benchmark yield on 10-year gilts closed unchanged at 7.15%.

Late on Tuesday, Fitch said that it had downgraded USA’s country rating by a notch to ‘AA+’ from ‘AAA’, due to anticipated deterioration of its fiscal position, including high deficits. Economists and analysts expect the US 10-year yield to rise, which in turn could lead to some shift of investor interest away from risky assets like emerging market stocks, including Indian shares.

The day’s selling on Dalal Street came on the back of heavy offloading by foreign funds, market players said. According to them, Fitch’s decision to downgrade, along with weak economic data from the US, the EU and China, led to a rise in risk-off trades among traders and investors around the world, including in India.

According to Vinod Nair, head of research, Geojit Financial Services, the Indian market witnessed a broad sectoral slide on the back of weak global market trends. “Negative news regarding the US rating downgrade on fiscal concerns, coupled with weak factory activity data from Eurozone and China, led to widespread worries across the globe.” Additionally, selling by FPIs, triggered by a rise in US bond yields, has disrupted the mood of the domestic market, he said.

As a reaction to Fitch’s decision on the US, on Wednesday Nikkei in Japan closed 2.3% lower while Hang Seng in Hong Kong lost 2.5% and FTSE in the US was down 1.4% in late-session. Across the Atlantic, Dow Jones, Nasdaq and S&P 500 indices were all down deep in the red in early trades with tech-heavy Nasdaq leading with a 2.5% slide.

In the domestic market, FPIs were net sellers at Rs 1,878 crore, BSE data showed. The day’s selling on Dalal Street also left investors poorer by Rs 3.3 lakh crore with BSE’s market capitalisation now at Rs 306.1 lakh crore, official data showed.

[ad_2]

Source link

More Stories

India’S Growth Forecast: S&P ups India’s FY’24 growth forecast to 6.4% on robust domestic momentum

India to remain fastest-growing major economy, but demand uneven: Poll

Jack Ma: Jack Ma gets back into business with ‘Ma’s Kitchen Food’