[ad_1]

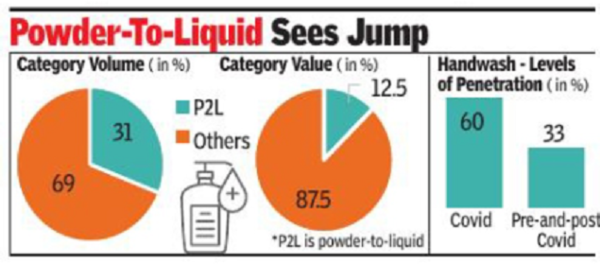

However, what’s growing rapidly within the handwash category is the powder-to-liquid (L) format which is cheaper than the average price of a toilet soap bar (priced in the range of Rs 27-30 for 100 gm). L has disrupted the handwash market since its introduction by Godrej Consumer Products five years ago. It now commands over 31% of handwash category volumes, prompting other companies to launch L products.

L is growing mainly on the back of the perception that liquid handwash is expensive. GCPL’s powder sachet (which makes 200 ml of liquid handwash) is priced at Rs 10, which is less than one-third the cost of existing liquid handwash refills. In value terms, therefore, L’s contribution is lower – at about 12.5% of the Rs 1,000-crore handwash market.

Ashwin Moorthy, CMO, GCPL, said,”Given that we save on plastic in L, we’re able to offer the consumer a product that costs one-third of the regular hand wash would cost. Till 2021, we were the only players. Last year, many other brands moved into the L format. It has driven the category to change. L now contributes to a third of the entire handwash category. We are the market leaders in L with more than 50% market share within the category.”

L has pulled consumers not only from among non-users of handwash, i.e. those who use toilet soap bars as handwash, but also those who use liquid handwash – which means the segment is partly cannibalising liquid handwash products. A Hindustan Unilever spokesperson, said, “The pandemic has proved that a simple habit like handwashing can be lifesaving. However, the penetration levels of the handwashing category have come down post-Covid.,”

Moorthy, however, said L has kept the hand washing habit alive. “Four of 10 households are already penetrated with hand wash. Half the gains are coming from new users while the other half are coming from consumers who have moved from liquids to L,” said Moorthy.

Neeraj Khatri, chief executive, Wipro Consumer Care, India & Saarc, said, “Post-covid, category penetration has reduced but settled higher than pre-Covid levels. The category has started seeing steady growth after settling at a new base post-Covid. In addition, we see that the frequency of usage has increased. Bigger value pack sales have been booming,” said Khatri.

[ad_2]

Source link

More Stories

India’S Growth Forecast: S&P ups India’s FY’24 growth forecast to 6.4% on robust domestic momentum

India to remain fastest-growing major economy, but demand uneven: Poll

Jack Ma: Jack Ma gets back into business with ‘Ma’s Kitchen Food’