[ad_1]

The day marks the start of the new Hindu year and India’s stock exchanges hold a special one-hour session where investors and traders make ceremonial purchases.Property developers as well as leading producers of cement, cables, and chemicals are among the picks this season.

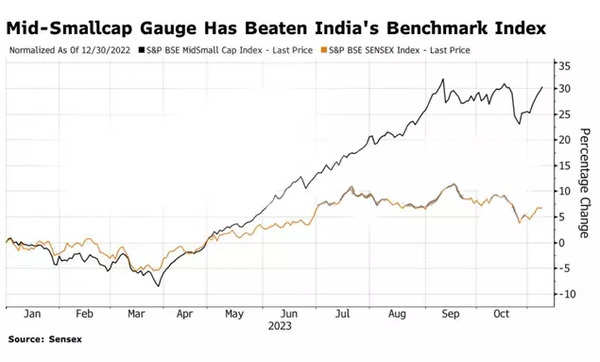

Small- and mid-cap stocks have trounced their larger peers this year amid bets that domestic-facing names will benefit more from the nation’s economic growth that is among the world’s fastest. The S&P BSE MidSmall Cap Index has surged 30% since Jan. 1, more than four times the gain in the benchmark S&P BSE Sensex Index.

Here are some of analysts’ top picks for the festival season:

SBI Securities

Polycab India Ltd

The maker of cable and wires has expanded its presence in the electrical goods business in recent years and has also won contracts for rural electrification projects

The electrical goods business forms about 15% of its revenue and is expected to make a profit on an operating basis starting 2025

Polycab has set a revenue guidance at 200 billion rupees by March 2025, about 40% more than in fiscal year 2023. But with the turnaround in the company’s consumer business, analysts at SBI expect the number to be raised in the next two-to-three quarters

Kolte-Patil Developers Ltd

The realty firm’s shares have rallied more than 70% this year, outperforming a 50% rise in BSE Ltd.’s sector gauge. SBI analysts expect the company to benefit from its strategy to expand into multiple markets, mainly via apartment redevelopment projects in Mumbai

The company plans to foray into afforable housing category in Pune, the western Indian city that continues to drive its major projects.

HDFC Securities

Gujarat Alkalies and Chemicals Ltd

The caustic soda and chlorine products maker has completed the majority of its capex including its joint venture with National Aluminum, the benefits of which will start to flow in the coming quarters

The company is a part of firms controlled by the western state of Gujarat and will abide by its rules for return of capital that includes paying out 30% of net income — or 5% of networth — as dividend

Gujarat Alkalies paid a dividend of 23.55 rupees, or a payout of 42%, for 2023 versus 10 rupees in the preceding year, and is expected to keep the payout at 30%-35%

Kalpataru Projects International Ltd

The company has a presence across power transmission, oil & gas, and civil infrastructure businesses and holds orders more than three times its revenue for the latest year.

Kalpataru has indicated a strong bidding pipeline of about 1 trillion rupees and will be tapping global projects as companies’ push for renewables will lead to requirements for new transmission lines

Nirmal Bang Institutional Equities

Cipla Ltd

The North American market accounts for about 25% of Cipla’s revenue, giving the company a smaller share than its peers. The generic drugmaker plans to focus on the respiratory segment there, where it faces less competition

CCL Products India Ltd

The company is the country’s biggest exporter of coffee and will continue to benefit from the ongoing crisis in Europe as the region is expected to import more from India and Vietnam, where CCL has factories

CCL’s ability to offer multiple blends in higher volume and its diverse sourcing capabilities are the differentiating factors besides its strong thrust on R&D and technology

Kotak Securities

Dalmia Bharat Ltd

The cement maker has a strong balance sheet and limited leverage and this allows its expansion, including inorganic growth opportunities. The company has a strong presence in eastern and southern parts of India and the regions have seen sharp price hikes, which will aid margins in the coming quarters

Canara Bank

The lender’s ratio of bad debts has shrunk to a multi-year low, but the stock with a 16% surge this year has trailed peers such as Indian Bank and Bank of Maharashtra, which have rallied more than 40%

The bank has seen a drop in credit costs in recent quarters, which has helped it improve return-over-equity ratio even though it continues to trade at a discount to peers.

[ad_2]

Source link

More Stories

India’S Growth Forecast: S&P ups India’s FY’24 growth forecast to 6.4% on robust domestic momentum

India to remain fastest-growing major economy, but demand uneven: Poll

Jack Ma: Jack Ma gets back into business with ‘Ma’s Kitchen Food’