[ad_1]

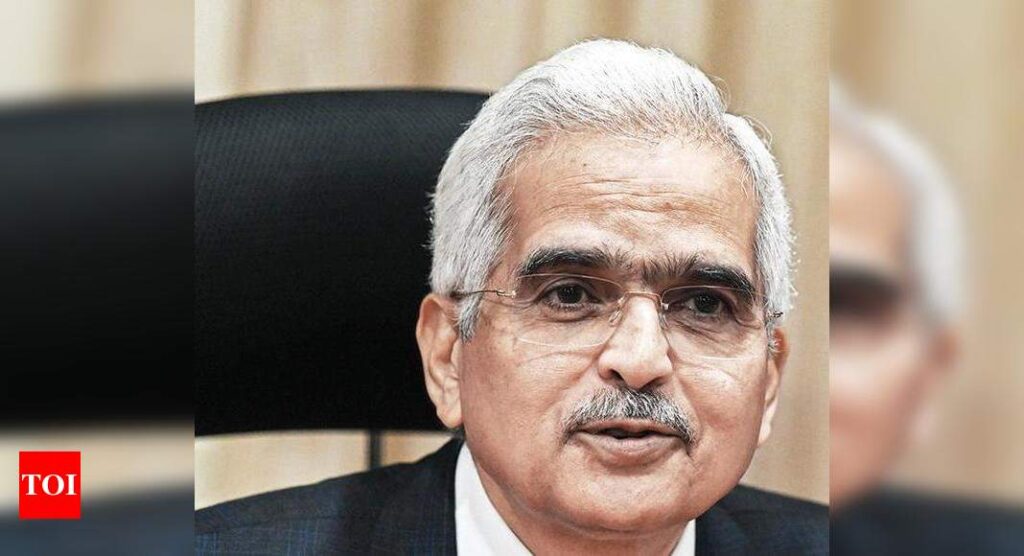

“Recent experiences highlight how the perceived stigma and limited access to IMF programmes are prompting countries to seek support from other lenders instead of IMF, resulting in potential debt sustainability issues. It would be beneficial if programmes could be designed with reduced conditionality,” Das said at a G20 seminar organised by the department of financial services and RBI.

The governor said a larger and more robust IMF is needed to manage risks. “The scale of IMF’s assistance is tied to the quota size of countries, and the completion of the 16th general quota review and associated requirements, including governance reform, should be expedited,” Das said.

The governor’s recommendations for the IMF and World Bank were among three proposals to address concerns of indebted economies.

Das proposed establishing a global platform for sharing debt-related data to enhance understanding of indebtedness. While this may be time-consuming, Das suggested employing proxies for calculating debt by utilising data on capital flows and locational banking statistics from entities like the Institute of International Finance and Bank for International Settlements.

The governor also called for introducing innovative tools such as debt-for-development swaps and green debt relief programmes.

Das noted the potential of digital public infrastructure in advancing financial inclusion. “Our sustained engagement in India Stack and the UPI particularly during the pandemic, has instilled the belief that digital public infrastructure like UPI can serve as a crucial global public good when expanded beyond national boundaries,” he said.

[ad_2]

Source link

More Stories

India’S Growth Forecast: S&P ups India’s FY’24 growth forecast to 6.4% on robust domestic momentum

India to remain fastest-growing major economy, but demand uneven: Poll

Jack Ma: Jack Ma gets back into business with ‘Ma’s Kitchen Food’