[ad_1]

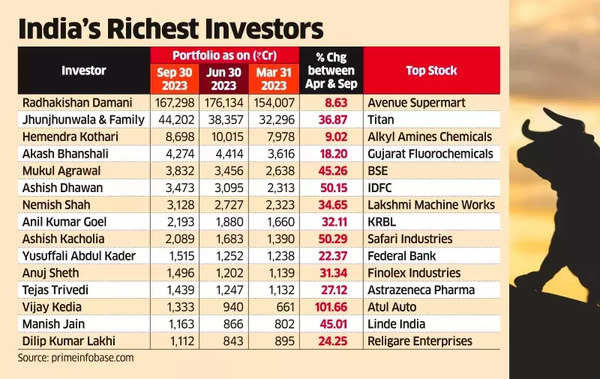

Leading the pack is Radhakishan Damani, the founder of supermarket chain DMart, with a portfolio worth Rs 1.67 lakh crore.Alongside his majority stake in Avenue Supermarts, the parent company of Dmart, Damani also holds shares in VST Industries, India Cements, and Trent, among others, the report said. However, his portfolio experienced a 5% decline in the September quarter.

Meanwhile, the family of the late Rakesh Jhunjhunwala witnessed a 37% rise in their share portfolio, reaching Rs 44,202 crore between April and September. These portfolio values were calculated based on their holdings of more than 1% in a company.

India’s Richest Investors

The rally in the market also enabled three individual investors – Vijay Kedia, Manish Jain, and Dilip Kumar Lakhi – to surpass the Rs 1,000 crore mark in their portfolios.

While Hemendra Kothari, the owner of DSP Mutual Fund, and Akash Bhanshali of Enam experienced a decline in their portfolio values during the September quarter, the remaining 12 investors recorded gains ranging from 11% to 41% during the same period, the financial daily’s analysis highlighted.

Notably, Mukul Agrawal of Param Capital witnessed a 45% growth in his portfolio since April, while Ashish Dhawan and Ashish Kacholia saw their wealth increase by more than 50% in the six months ending in September.

The Indian equity markets have been rally in this fiscal year, but in the recent weeks have seen volatile sessions due to global economic and geopolitical turbulence.

[ad_2]

Source link

More Stories

India’S Growth Forecast: S&P ups India’s FY’24 growth forecast to 6.4% on robust domestic momentum

India to remain fastest-growing major economy, but demand uneven: Poll

Jack Ma: Jack Ma gets back into business with ‘Ma’s Kitchen Food’