[ad_1]

NEW DELHI:

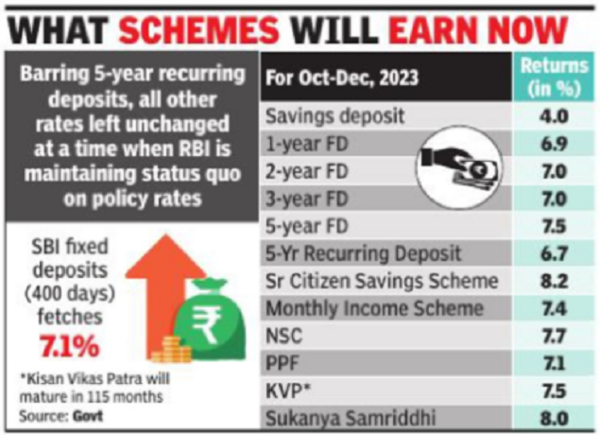

The finance ministry on Friday left interest on all small savings instruments unchanged, barring five-year recurring deposits, which will fetch 6.7% during the October-December quarter, instead of the current 6.5%.

The status quo on rates comes days before the monetary policy committee meets, amid signs of cooling inflation, which had soared to 7.4% in July but has remained above the tolerance level of 6%. By all accounts the monetary policy committee is expected to leave key policy rates unchanged once again.

The government notifies the interest rate on small savings schemes every quarter. The rates are to be aligned to the prevailing market rates, based on a formula, but deviation from it is not unusual.

Higher interest rates on small savings schemes, such as public provident fund and Kisan Vikas Patras, would force banks to raise deposit rates at a time when loan growth remains high.

This in turn would put pressure on lending rates, something that the government may not be keen on, given that it is seeking to spur demand, while also getting the private sector to step up capital expenditure in creating new manufacturing capacity or expansion of existing factories. In a note, Care Ratings said that bank deposit rates have not yet fully reflected the increased interest rates.

[ad_2]

Source link

More Stories

India’S Growth Forecast: S&P ups India’s FY’24 growth forecast to 6.4% on robust domestic momentum

India to remain fastest-growing major economy, but demand uneven: Poll

Jack Ma: Jack Ma gets back into business with ‘Ma’s Kitchen Food’