[ad_1]

Edelweiss had filed the company petition last year to initiate Corporate Insolvency Resolution Process against the Corporate Debtor for unresolved financial debt of Rs 252 crore. “The Financial Creditor has successfully proved the existence of “debt” and “default” through the record of default issued by the NESL (National E-Governance Services Ltd) apart from other security documents and loan documents,’’ said NCLT in its July 25 order passed by H V Subba Rao, Member (Judicial) and Anu Singh, member (Technical).

Edelweiss said the dues were over Rs 200 crore under a First Loan Agreement and almost Rs 49 crore under the Second Loan Agreement. The company petition was originally filed by CFM Asset Reconstruction pvt ltd as a financial creditor under the Insolvency and Bankruptcy Code and during its pendency the debt was reassigned to Edelweiss Asset Reconstruction Company .

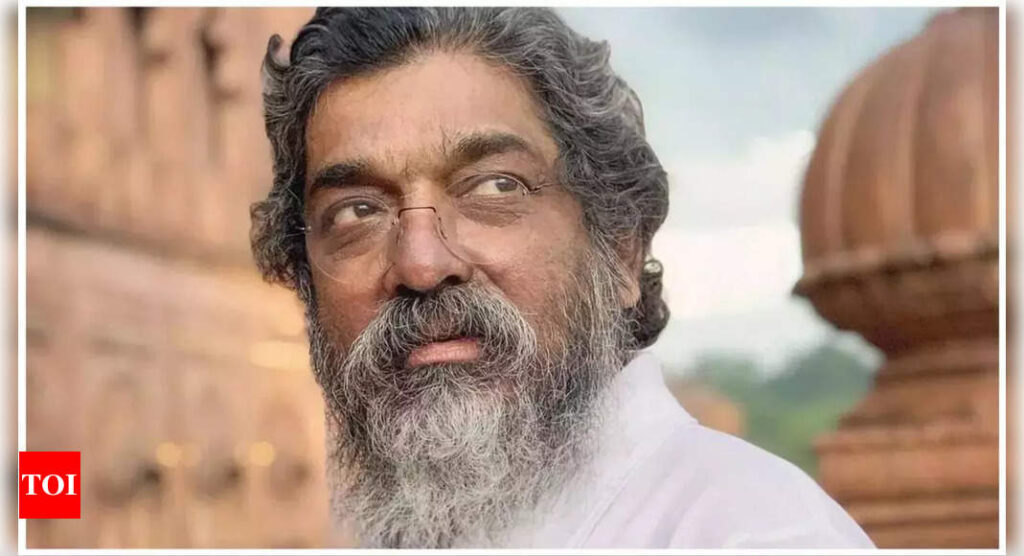

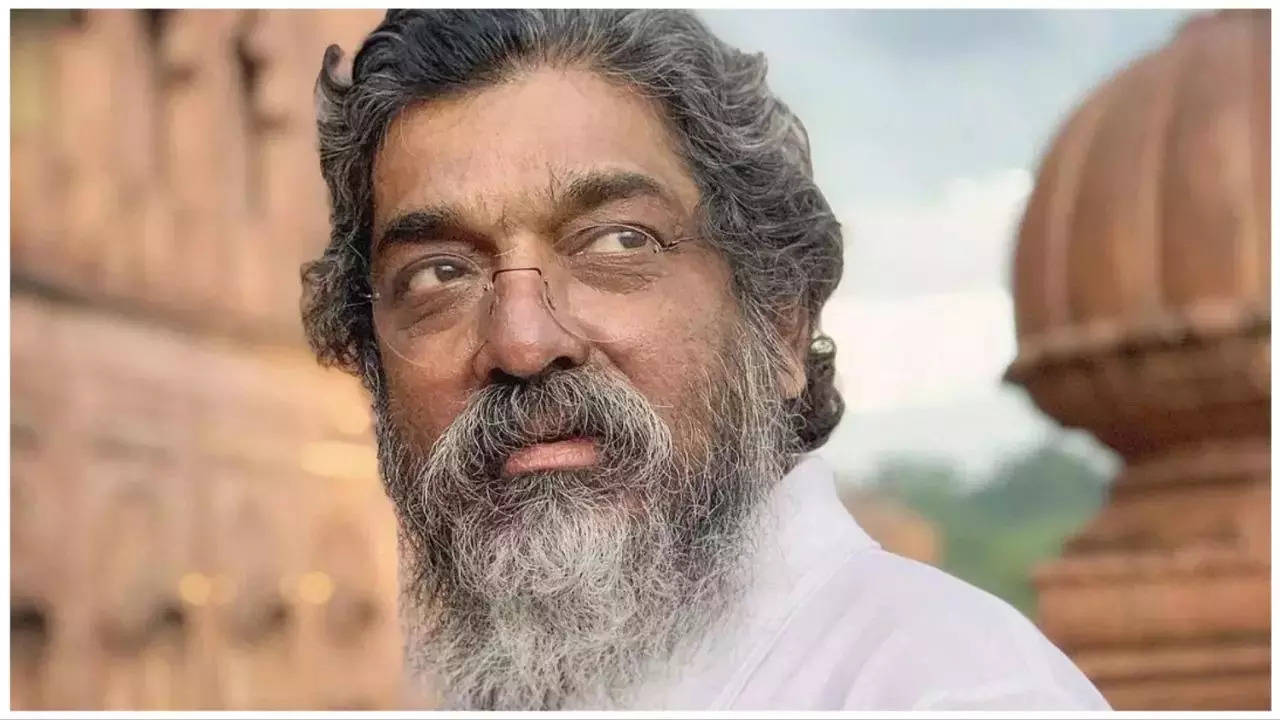

ND’s Art World incorporated in December 2002 had been engaged in the business of organizing and maintaining operating replicas of historical monuments and providing facilities and services related to hotels, theme restaurants, shopping malls and recreation centres, the NCLT order noted.

In 2016 it sought a loan of Rs 150 crore from a finance company and along with loan agreement “various security documents securing the loan were also executed by the Corporate Debtor, Nitin Chandrakant Desai and Naina Nitin Desai and KND Investments and Finance Private Limited.” It later availed a second loan of Rs 31 crore, making the debt RS 181 crore.

Opposing the company petition, ND’s Art World said it had obtained the loan from ECL Finance Ltd and questioned the rights of Edelweiss as the ‘Financial Creditors’ to invoke insolvency law to recover the alleged outstanding dues from it based on a claim of having been assigned the debt in 2020.

The NCLT order said a “careful perusal of the affidavit in reply” filed by ND’s made it “abundantly clear that the Corporate Debtor is neither disputing the “debt” nor the “default” through their own reply.” It added, ” The Corporate Debtor did not raise any valid legal defence for rejection of the above Company Petition.”

The NCLT heard senior advocate Mustafa Doctor for Edelweiss and advocate Amir Arsiwala for ND’s.

The Tribunal said it was “surprising’’ that the plea raised in the final hearing by ND’s lawyer about ‘date of default’ was never raised by the company anywhere in its reply affidavit.

“The date of default is mentioned as 31.01.2020 in the NESL Certificate in the record of default and the above Company Petition being filed on 26.07.2022 is well within limitation,’’ said NCLT rejecting the ‘date of default’ argument on merits.

The NCLT appointed Jitender Kothari as insolvency interim resolution professional and prohibited the institution of suits or continuation of pending suits or proceedings against the corporate debtor (ND’s Art World) including transferring or selling by Desai’s company, thus setting into motion, a moratorium till competition of corporate insolvency process.

[ad_2]

Source link

More Stories

India’S Growth Forecast: S&P ups India’s FY’24 growth forecast to 6.4% on robust domestic momentum

India to remain fastest-growing major economy, but demand uneven: Poll

Jack Ma: Jack Ma gets back into business with ‘Ma’s Kitchen Food’