[ad_1]

CEOs from leading FMCG companies told TOI they expect the emergence of nuclear families to boost demand for products and also push sales of premium categories like liquid detergents.

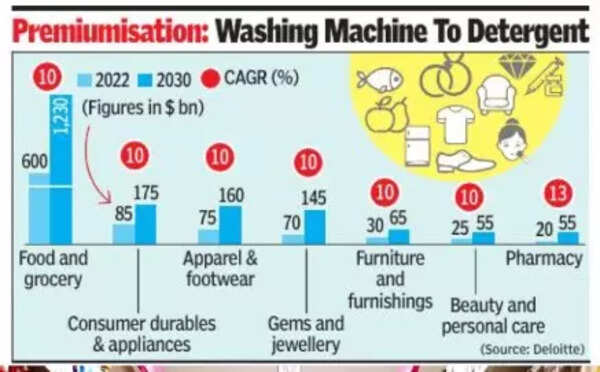

Several studies have shown how urbanisation is going to accelerate, thus bolstering demand for consumer products. Now, a report by Deloitte shows how this trend will also drive the retail sector. By 2030, India is set to add 110 million middle-income households (currently at 190 million) and 14 million high-income households (at 15 million now). It defines middle-income households as those earning between Rs 3-30 lakh per annum, while high-income category makes over Rs 30 lakh annually.

In a recent interview with TOI, Nitin Paranjpe, chairman, Hindustan Unilever (HUL), said urbanisation (percentage of the population staying in urban areas) is a big trend that can boost consumption. “When somebody moves from a joint family to a nuclear family, the consumption of that household grows by 20%,” he said. Premiumisation, for instance, is a key vector of HUL’s growth strategy.

Ipsos India CEO Amit Adarkar said, “In 2011, 31. 3% of Indians stayed in urban areas. In 2021, the figure rose to 35. 4%, and by 2035, the percentage is expected to go up to 43%. This urbanisation shift and accompanying affluence will contribute to consumer goods’ growth. ”

As more people start living in urban households, it means more homes and surfaces to clean. In a recent interview with TOI, Procter & Gamble India CEO & MD, L V Vaidyanathan, said consumers’ needs change dramatically with urbanisation, more nuclear families, and women joining the workforce. Vaidyanathan elicited the example of the growth in sales of automatic washing machines which has resulted in a demand generation for liquid detergents.

India’s demographic is undergoing a shift, characterised by a surge in the urban young, predominantly led by millennials and Gen Zs. As in come levels rise, millennials and Gen Zs in India are increasingly seeking convenience, value-added services, and are willing to pay a premium for it, says the Deloitte report.

The growth in high and middle-income households, higher participation in the organised labour market along with demographic shifts towards a younger population will make India’s cities some of the most attractive markets for FMCG companies in the world, Anand Ramanathan, partner, and consumer industry leader (consulting), Deloitte India, said.

“Convenience and variety seeking consumer behaviour, heightened awareness from travel, quick commerce, and growth in modern trade are some of the major drivers for increasing the sales of discretionary FMCG products in urban India,” said Ramanathan.

[ad_2]

Source link

More Stories

India’S Growth Forecast: S&P ups India’s FY’24 growth forecast to 6.4% on robust domestic momentum

India to remain fastest-growing major economy, but demand uneven: Poll

Jack Ma: Jack Ma gets back into business with ‘Ma’s Kitchen Food’