[ad_1]

Next week, financial services secretary Vivek Joshi will hold consultations with the Reserve Bank of India (RBI), Trai, telecom department and the National Payments Corporation of India (NPCI), among others, while the standing committee has already held talks with the finance ministry and Punjab National Bank (PNB) MD on the matter.

The department of financial services has roped in the Indian Cyber Crime Coordination Centre (I4C), an agency under the home ministry, which will present data from the four-year-old National Cybercrime Reporting Portal and also the challenges being faced by agencies. Although banks have had little control, State Bank of India’s experience in dealing with the growing menace is also on the agenda.

While mechanisms are in place and banks are seeking to educate consumers on keeping their data secure, in a large number of cases, account holders have been found to share their passwords or screen with fraudsters who siphon off funds. Banks have expressed their inability to protect consumers in such situations, prompting the regulator and the government to explore multiple options to ensure that money even if transferred from one account can be stopped from flowing out.

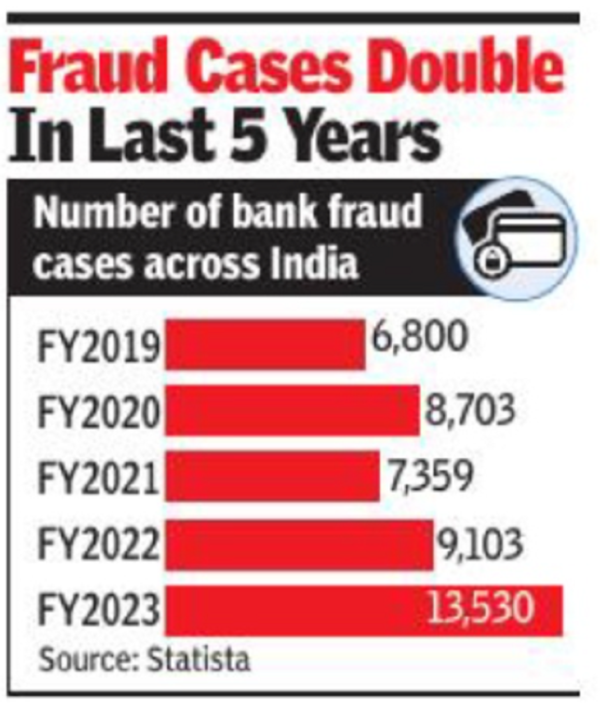

According to data, nearly 13,500 frauds were reported last year (see graphic), as against 9,100 in FY22 – an increase of almost 50%. Many, however, believe that the numbers do not present the full picture as consumers often find it tough to register a complaint.

Separately, the government and the RBI are also looking into the issue of lapses at UCO Bank.

[ad_2]

Source link

More Stories

India’S Growth Forecast: S&P ups India’s FY’24 growth forecast to 6.4% on robust domestic momentum

India to remain fastest-growing major economy, but demand uneven: Poll

Jack Ma: Jack Ma gets back into business with ‘Ma’s Kitchen Food’