[ad_1]

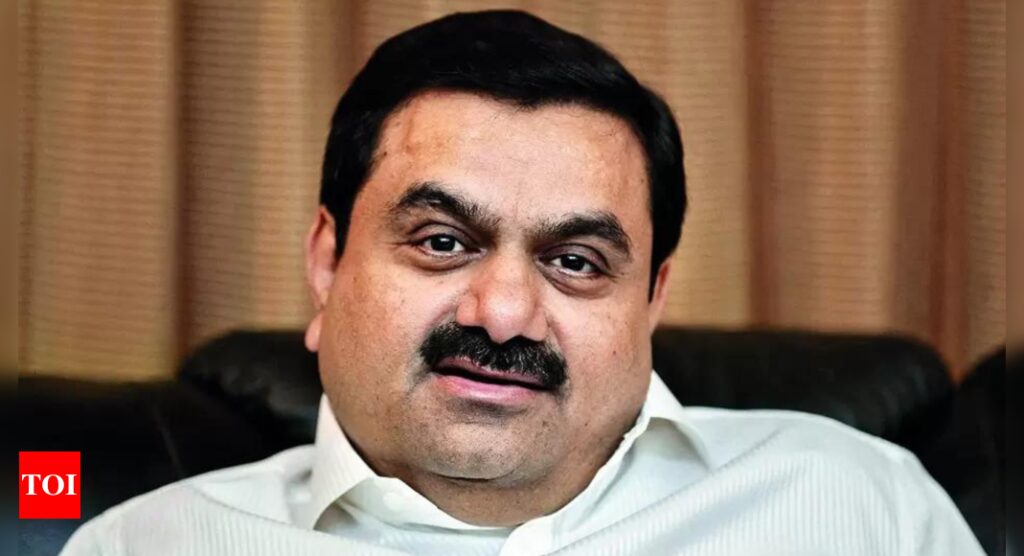

Ambuja Cements, which Adani acquired in September 2022, will buy 57% in Sanghi from the promoter family. The deal, expected to be concluded in three to four months, will increase Ambuja’s capacity to 73.6 million tons from 67.5 million.

Ambuja will make an open offer for another 26% stake in line with takeover rules. The Sanghi family will receive Rs 1,674 crore for their 57% stake, while Ambuja will spend an additional Rs 767 crore for the open offer. Ambuja said the offer valued Sanghi at Rs 114 per share – an 8% premium to its closing price of Rs 106 on the BSE on Thursday. The deal, subject to approval from the anti-competition regulator, will be financed through internal accruals. Ambuja, along with its subsidiary ACC, held cash and equivalents of Rs 11,886 crore as on June 30. Ambuja will also lend Rs 300 crore to Sanghi.

Incorporated in June 1985, Sanghi has a manufacturing facility in Gujarat’s Kutch region – it is the country’s largest single-location cement and clinker unit. The company, with a turnover of Rs 928 crore, had reported a loss of Rs 326 crore in FY23.

The acquisition, Adani said, is a “significant step forward” in Ambuja’s “accelerating growth journey”. Adani plans to phase out the Sanghi brand of cement and will operate the building materials business under the brand umbrella of Ambuja and ACC, said a person in the know. Interestingly, Ambuja hasn’t signed any non-compete agreement with Ravi Sanghi and family, allowing both the parties to be engaged in the cement business. The Sanghi acquisition is part of Adani’s goal of having a cement capacity of 140 million tons by 2027.

[ad_2]

Source link

More Stories

India’S Growth Forecast: S&P ups India’s FY’24 growth forecast to 6.4% on robust domestic momentum

India to remain fastest-growing major economy, but demand uneven: Poll

Jack Ma: Jack Ma gets back into business with ‘Ma’s Kitchen Food’