[ad_1]

The weak equities market also impacted the inter-bank foreign exchange market. During the day, the rupee weakened by another 15 paise to close at 82.73 against the dollar – a two-and-a-half-month low. On Wednesday, the rupee had slid 32 paise to 82.58 against the dollar.

In the government bond market, the benchmark yield on the 10-year gilts also hardened by 5 paise to close at 7.2%, official data showed. The day’s slide in the market left investors poorer by a little over Rs 1 lakh crore with BSE’s market capitalisation now at Rs 305 lakh crore.

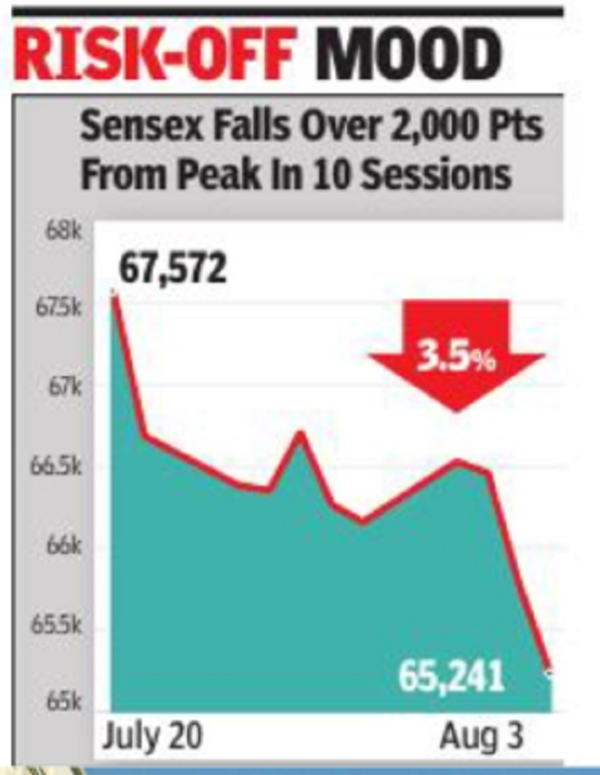

The sensex opened marginally lower and for a brief period it traded in the black. However, renewed selling pulled it down to an intraday low just below the 65,000 mark. Some end-of-the-session buying helped it recover some ground and it closed with a loss of 0.8%.

Global markets are still grappling with the impact of the US rating downgrade by Fitch, with spiking bond yield and strengthening dollar index, Vinod Nair of Geojit Financial Services said. “However, (in India) the pharma sector has managed to weather the storm due to its strong earnings outcome.”

[ad_2]

Source link

More Stories

India’S Growth Forecast: S&P ups India’s FY’24 growth forecast to 6.4% on robust domestic momentum

India to remain fastest-growing major economy, but demand uneven: Poll

Jack Ma: Jack Ma gets back into business with ‘Ma’s Kitchen Food’