[ad_1]

Strength of the domestic economy is said to have acted like a shield. The overseas contribution for the top 30 Indian brands accounts for 31% of brand value, compared with 47% for Japan, 59% for the UK, and 85% for France. This has protected the ranking from the worst effects of international volatility, said Kantar.

But de-averaging reveals stark differences in consumer purchase habits, the ups and downs of individual brands and varied segmental growths within a category. Kantar said the impact of wider economic change on people’s everyday lives in India is not well represented by averages. There is a resilient and affluent upper class that has remained largely unaffected by inflation, and a large tier of low-income earners, who have been protected from rising prices for essentials by government aid schemes and subsidies.

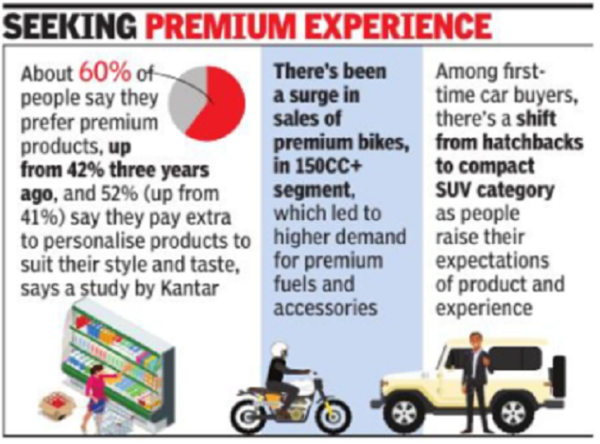

With the proportion of households with monthly income of over Rs 40,000 increasing in the past three years from 3% to 6% and the proportion in the Rs 15,001-20,000 bracket surging from 17% to 23%, shopping habits have changed considerably. About 60% of people say they prefer premium products – up from 42% three years ago, and 52% (up from 41%) say they pay extra to personalise products to suit their style and tastes.

[ad_2]

Source link

More Stories

India’S Growth Forecast: S&P ups India’s FY’24 growth forecast to 6.4% on robust domestic momentum

India to remain fastest-growing major economy, but demand uneven: Poll

Jack Ma: Jack Ma gets back into business with ‘Ma’s Kitchen Food’