[ad_1]

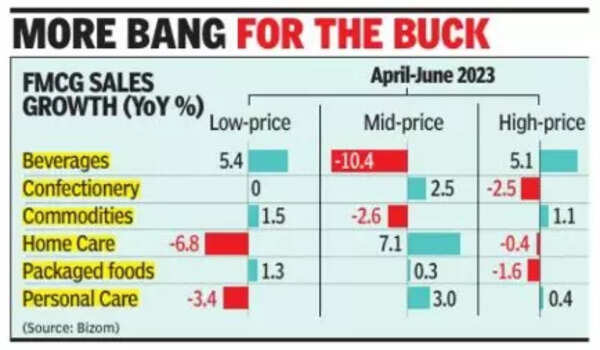

Confectionery (-7. 6%) and personal care (-11. 5%) categories witnessed a decline in growth in the June quarter of 2023, as compared to the same quarter last year, while home care posted a double-digit growth of 14. 7%. The trend of mid-priced packs growing at a faster pace than low-unit price points and high-priced packs across these categories appears to be an outlier.

In confectionery, mid-priced packs grew 2. 5% during the quarter, while the growth in high-value packs in the same category declined by an equal proportion. In personal care, consumers clearly upgraded to mid-priced packs which grew by 3%, while low-priced packs declined by 3. 4%. In home care, mid-priced packs rose 7. 1%, as consumers uptraded from low-price packs (-6. 8%), thus driving growth in this category.

Bizom’s chief of growth and insights, Akshay D’Souza, said, “Consumers seem to be looking for greater value among confectionery, personal care as well as home care products. Here we see a strong movement into multiuse, mid-sized packs that offer the flexibility of limited spending and greater value than smaller sized ones. ”

Confectionery products have the highest contribution from urban consumption as compared to any other category. “Traditionally, we’ve seen school and college activities help drive sales for this category. In this season, though inflation is lower it has still impacted consumption of discretionary products including confectionery where there have been no real drop in prices. As a result, we do see spends shifting from high to mid-value packs as consumer wallet share for this category gets rationalized,” said D’Souza of Bizom, which automates retail execution at 7. 5 million kirana stores.

Desmond D’souza, senior director sales at Mondelez India, a leading chocolate maker, however, said, the company has not seen significant shift in the patterns of growth in packs across price points for the categories the company operates in. “The trend is very similar to last year and we continue to experiencees shift from a price-led growth to a consumption-led growth strategy and there are more schemes being offered for higher size packs. This is helping incentives customers to move to these multi-use packs. However, among products like perfumes, deodorants & body sprays we still see companies looking to grow using pricing levers. As a result, we still don’t see any significant movement amongst pack consumption here,” said Bizom’s D’Souza.

In home care, there’s a shift towards consumptionled growth in detergents, although slower, as compared to toilet and floor cleaners.

[ad_2]

Source link

More Stories

India’S Growth Forecast: S&P ups India’s FY’24 growth forecast to 6.4% on robust domestic momentum

India to remain fastest-growing major economy, but demand uneven: Poll

Jack Ma: Jack Ma gets back into business with ‘Ma’s Kitchen Food’