[ad_1]

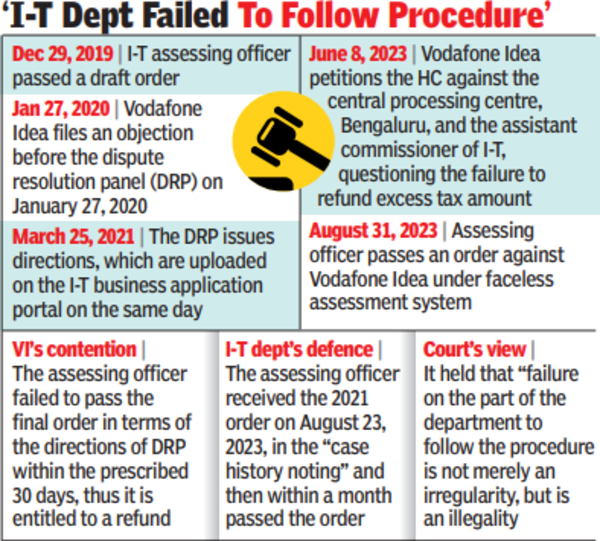

On August 31, 2023, an assessing officer passed an order against Vodafone Idea, two years after a dispute resolution panel (DRP) issued directions to the company.The order was issued under the faceless assessment system, which seeks to eliminate the human interface between taxpayers and the I-T department. Vodafone Idea had contested that the assessing officer had failed to pass the final order in the prescribed period.

A division bench of Justices K R Shriram and Neela Gokhale also recommended an inquiry against the assessing officer for “failure to abide by the legal mandate and the lack of diligence on the part of officials concerned”. “Strict action should be taken against persons responsible for the laxity and lethargy displayed which has caused a huge loss to the exchequer and, in turn, to citizens of this country,” said the judgment, directing that a copy of the order be given to CBDT and principal secretary of the Union finance ministry. The court directed the process to be completed in 30 days.

Vodafone Idea had on June 8, 2023, petitioned the HC against the central processing centre, Bengaluru, and the assistant commissioner of income-tax, questioning the failure to refund excess tax amount on income. The assessing officer passed a draft order in this case on December 29, 2019, against which the company filed an objection before the DRP on January 27, 2020. On March 25, 2021, the DRP issued directions which were uploaded the same day on the income tax business application (ITBA) portal.

Vodafone Idea contested that the assessing officer failed to pass the final order in terms of the directions of DRP within 30 days, the period prescribed under Section 144C(13) of the Act, and consequently said it is entitled to refund with interest. The company’s senior counsel, J D Mistri, said once a DRP order is uploaded and is available when no order is passed in a month, the income declared by Vodafone Idea is deemed to be accepted by the I-T department, and the petitioner, entitled to a refund of excess tax.

After the petition was filed, the assessing officer passed its order on August 31, 2023, the HC noted. Defending the actions of the department, advocate Devvrat Singh said the assessing officer received the 2021 order on August 23, 2023, in the “case history noting” and then within a month passed the order.

The HC, after analysing the law and the assessment proceeding scheme under the e-assessment scheme, said, “Any notice, summons, or order is deemed to have been received by the assessing officer once it is available to the NeAC (National e-Assessment Centre).” The HC held that “failure on the part of the department to follow the procedure under Section 144C of the Act is not merely a procedural irregularity, but is an illegality and vitiates the entire proceeding”.

[ad_2]

Source link

More Stories

India’S Growth Forecast: S&P ups India’s FY’24 growth forecast to 6.4% on robust domestic momentum

India to remain fastest-growing major economy, but demand uneven: Poll

Jack Ma: Jack Ma gets back into business with ‘Ma’s Kitchen Food’