[ad_1]

Zurich has signed a deal to acquire up to 70% stake in the Kotak Mahindra Bankunit – it intends to acquire an additional stake of up to 19% over time.Part of the consideration will go to Kotak Mahindra Bank for the sale of shares, while some of it will be allocated towards subscribing to the fresh issue of shares by the insurer.

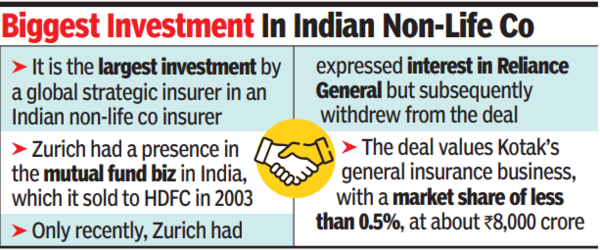

Prior to the opening up of the insurance industry in 2000, Zurich had a mutual fund presence in India, which it sold to HDFC in 2003. Zurich had also been exploring partnerships to enter the non-life business during the liberalisation period and had set up a representative office, but these plans were later abandoned. More recently, Zurich had expressed interest in Reliance General Insurance during the Reliance Capital bankruptcy process but subsequently withdrew from the deal.

Insurers have noted that Kotak Mahindra Bank has secured an excellent valuation for its non-life business. The deal values the general insurance business, which holds a market share of less than 0.5%, at more than one-third of the market cap of New India Assurance, valued at Rs 22,643 crore.

ICICI Lombard, the largest private insurer with a market share of 8.7%, has a valuation of Rs 67,500 crore. IndusInd Bank, the successful bidder for Reliance Capital, will pay Rs 10,000 crore for the company, which owns a general insurance company and a stake in a life insurance joint venture.

Kotak Mahindra General Insurance reported a net loss of Rs 117 crore in FY23, compared to a net loss of Rs 83 crore in FY22. The FY23 loss occurred despite a total premium income of Rs 673 crore, up from Rs 500 crore in FY22.

Kotak Mahindra Bank MD & CEO Dipak Gupta said, “Kotak Mahindra Group’s pan-India ‘phygital’ distribution presence and Zurich’s distinct global capabilities in digital assets, B2B, and B2C formats have the potential to create a transformational ‘digical’ impact for the Kotak General Insurance franchise, delivering innovation efficiently and rapidly in the Indian general insurance space.”

[ad_2]

Source link

More Stories

India’S Growth Forecast: S&P ups India’s FY’24 growth forecast to 6.4% on robust domestic momentum

India to remain fastest-growing major economy, but demand uneven: Poll

Jack Ma: Jack Ma gets back into business with ‘Ma’s Kitchen Food’